An airbag for your equity strategy

In the modern cars we drive today, all are installed with airbags. They are an extremely important feature in any car. They serve as the most basic component in reducing injuries during an accident, and as a supplement to protection offered by seat belts. A variable beta fund can provide similar protection for a long only equity strategy. By investing with a credible fund manager you are wearing a seat belt. By introducing a level of hedging into your portfolio, you are effectively installing an airbag.

Variable beta or long/short strategies are a relatively recent innovation in portfolio management. The reason these funds have been gaining popularity in the market is they offer investors a different outcome to a standard long only equities fund. The following provides information on how variable beta funds are designed to offer investors:

- Equity exposure with downside protection

- Superior risk adjusted equity returns over the long term

- A defensive alternative to a long only equity portfolio.

Long/short variable beta investing

Long/short variable beta strategies involve a manager adjusting the level of market exposure of the portfolio. The rationale is to enhance investor returns through

stock selection as well as reduce market/downside risk by hedging against adverse movements.

The approach allows a manager greater flexibility by using the following techniques:

- Vary market exposure: Ability to reduce the impact of market drawdowns, providing some level of protection when the market falls. It offers a superior risk/return outcome.

- Extend the long portfolio: Increasing exposure above 100% to a basket of quality companies that the manager expects will outperform the market expands the potential reward for outperformance. Leverage is used in a risk controlled manner.

- Enhance returns by shorting stocks: Benefit from investing in weak and low quality companies that are generally avoided by long only managers. Short selling these companies is another way to generate alpha if these companies fall or underperform the market.

The mechanics – how it works

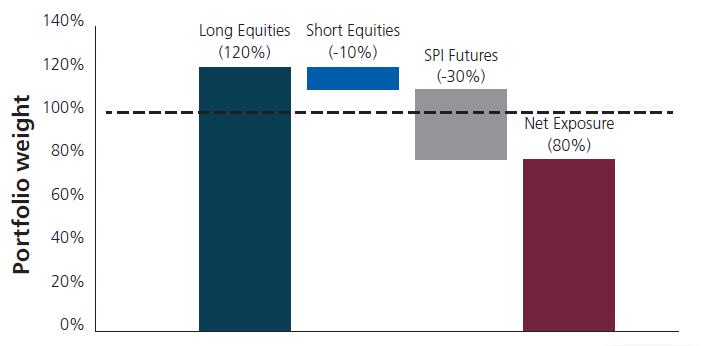

The following chart and the description below demonstrate how WaveStone might construct its variable beta strategy.

Step 1: Take a standard long only strategy of equities (assume $1 million dollars of value) and borrow $200,000 to increase exposure.

Step 1: Take a standard long only strategy of equities (assume $1 million dollars of value) and borrow $200,000 to increase exposure.

Step 2: Short sell $100,000 of stocks and direct the sale proceeds to reduce original borrowings.

Step 3: Sell an SPI Futures contract with a notional value of $300,000 (a contract to sell a basket of stocks at a set price in the future).

Net result: $1.1 million invested in equities ($1.2m capital less $100k short sold stocks), less $300k through selling short a SPI futures contract. This results in a net effective exposure of around 80%.

The purpose of reducing the net effective exposure to the market is to insulate the portfolio. The derivative provides a cushion or airbag, as it will increase in value in falling markets. By investing more in the long portfolio and introducing short selling, this feature is designed to provide additional opportunities to create value and to compensate for the reduced market exposure.

What is the purpose of short selling?

Short selling describes the process of generating positive returns from a fall in the price of shares. Positive returns are generated by selling a share today on the expectation of buying it back at a lower price in the future. The benefits of short selling from an investor’s perspective are that it increases the breadth of investment opportunities, beyond what a long only investor would consider. This provides a larger opportunity set to generate alpha.

Why use derivatives when you can use cash?

The index SPI Futures operates as a hedge mechanism to calibrate market exposure levels. The value of a short derivative position will rise when the market is falling, this provides greater protection than simply holding cash.

In the current low interest rate environment, the cost of borrowing and the returns on cash or equivalents are very low, supporting leveraged positions over holding cash.

Shorting individual stocks will increase the gross exposure with the potential to increase and magnify portfolio risk.

Market conditions most suitable for this type of strategy

The variable beta approach can outperform in both rising and falling markets.

- It will perform best when the manager’s stock picking is strong and the long/short positions are outperforming. The greater alpha opportunity set by using the long/short approach aims to compensate for lower market effective exposure.

- In a market that is volatile or falling, the approach should offer a level of protection, due to the short stock positions and lower market exposure.

Market conditions least suitable for this type of strategy

- A rapidly rising market, either euphoric multiple expansionary periods (bubbles) or market reversionary periods (rebound following a large drawdown). Generally this coincides with the market moving ahead of company fundamentals. A lower net effective exposure will mean the approach will not keep up with the market.

- When the manager’s style is out of favour. Depending on a manager’s stock selection there are times when an active manager will underperform. This results in lower levels of alpha which fails to compensate for the lower market exposure. This will result in periods of weaker performance.

Who is this strategy suitable for?

- Investors with intolerance for large drawdowns without sacrificing the majority of upside.

- Investors who need to reduce the sequencing risk in their equities portfolio.

Where to position a variable beta fund in your portfolio

- With a net equity exposure range between 50-100%, it is most likely to be considered as a growth option in a diversified portfolio of different asset classes.

- Within an equities portfolio, these strategies can complement a traditional long-only strategy to offer additional downside protection.

Variable beta or long/short funds can offer professional investors greater flexibility and a defensive alternative to standard long only funds. Variable beta strategies allow managers greater opportunity to exploit their areas of expertise by combining long only investing with short selling and hedging.