Climate change is changing the outlook for Energy Utilities

Australia’s electricity sector is the nation’s single largest source of greenhouse gas pollution, accounting for about a third of our total greenhouse gas emissions.

Extreme weather events related to climate change such as prolonged drought, bushfires, heatwaves and storms are becoming increasingly prevalent. Despite this, we are yet to see a consistent policy framework for lowering the energy sector’s carbon emissions. There have been several attempts such as the introduction of the Clean Energy Act 2011, which was subsequently repealed and the National Energy Guarantee (NEG) which included both reliability and emission reduction obligations, but ultimately didn’t eventuate. Rather than targeting emissions, federal policy has focused on encouraging investment in renewables technology via schemes such as the Large-Scale Renewable Energy Target and the Small-Scale Renewable Energy Scheme. Ultimately, a clear national policy framework that facilitates the decarbonisation of the Energy Utility Sector, whilst simultaneously ensuring the stability and security of supply, has not eventuated.

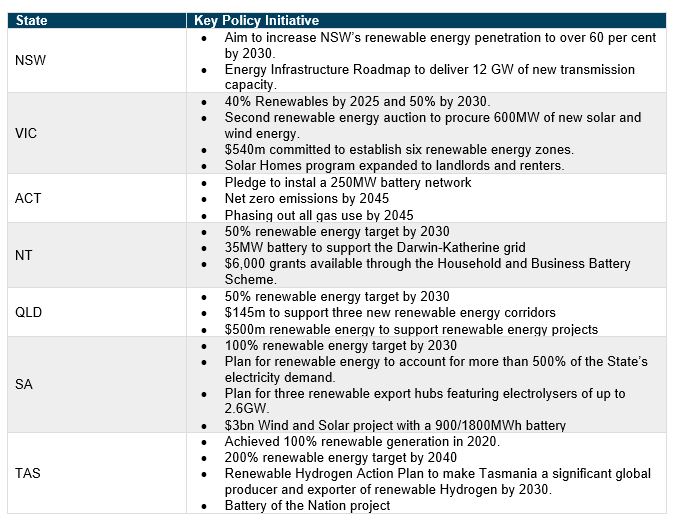

This lack of a nationally co-ordinated approach to manage a transition has resulted in the States each adopting their own policies, some more aggressive than others, but with most targeting net zero by 2050.

Selection of key State Policy initiatives facilitating a renewable energy transition

Source: Clean Energy Council – Clean Energy Australia Report 2021

Whilst these policies have evolved over time, the net effect has been to promote, via renewable subsidies as opposed to a carbon tax, investment into renewable energy.

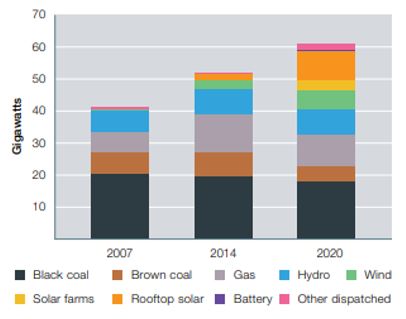

The growth of renewables in the Australian market

Over 93% of the investment in electricity generation since 2012-2013 has been in wind and solar capacity, driven by falling costs and government subsidies plus various state-based schemes and funding by ARENA and CEFC. As the chart below shows, the contribution of renewables to electricity generation has risen steadily over time.

Australian Energy Regulator – Changing Generation Mix

Source: Australian Energy Regulator – 2020 State of the Energy Market Report

As renewables become a greater part of the network, coal plants face increasing pressure.

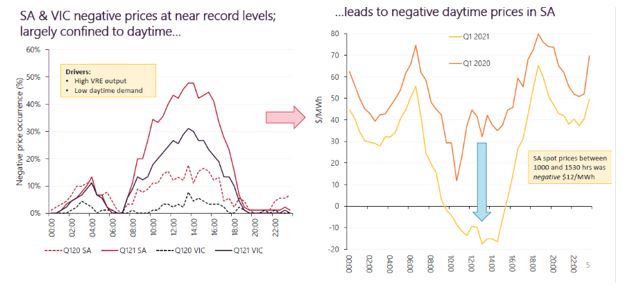

Firstly, coal plants are being forced to operate more flexibly as they are increasingly coming under commercial pressure from low and sometimes negative prices in the middle of the day. Wind and solar plants have no fuel cost, enabling them to bid at low prices plus rooftop solar systems, typically, are always dispatched (unless they are export limited). This results in the growing supply from wind and solar displacing higher cost generators.

High Variable Renewable Energy (VRE) output leads to negative daytime prices – SA example

Source: AEMO – Q1 2021 Energy Markets Update

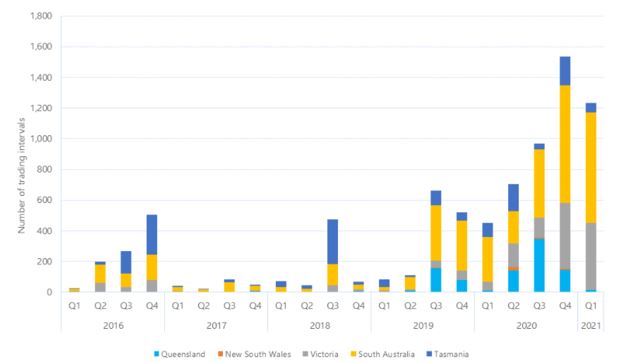

Over time, the number of negative pricing intervals has increased, as renewables have contributed a greater proportion of the energy mix. This is demonstrated in the chart below

Quarterly Count of Spot Prices below $0/MWh

Source: Australian Energy Regulator (https://www.aer.gov.au/wholesale-markets/wholesale-statistics/quarterly-count-of-spot-prices-below-0-mwh)

Increasing obsolescence of Coal

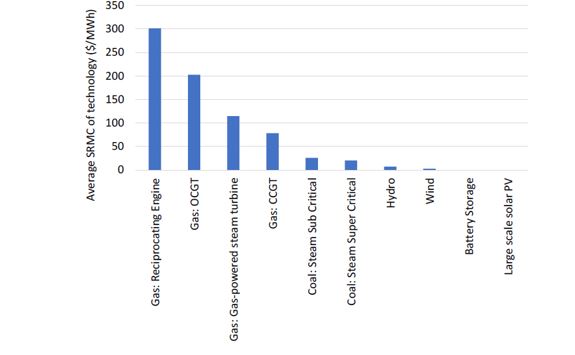

Coal fired generators are relatively inflexible and must run all the time. They cannot be switched on and off like a battery or peaking gas generator as required. This means that for a fair part of the day they can be burning coal and yet not making power that can be dispatched as it is too expensive compared to renewables. This is illustrated in the chart below which shows the short run margin cost of each technology in the National Energy Market (NEM).

Short Run Marginal Cost (SRMC) of Each Technology in the NEM ($/MWh)

Source: IEGGA.org – Australian Electricity Markets Overview – AEMO ISP Inputs & Assumptions Workbook

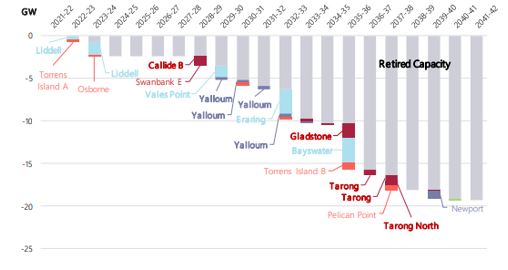

In addition, many of Australia’s major coal plants are approaching the end of their technical lives and lack the ability to respond flexibly when renewables generation spikes.

AEMO – Coal Fired Generation and GPG Retirements

Source: AEMO – Integrated System Plan 2020

The role of Gas

With coal plant viability under pressure it is prudent to consider the role of gas. With a short run marginal cost well above that of even coal, it remains completely displaced in the middle of the day. Gas, in this increasingly renewable world, is not needed for baseload but will be relied upon for short duration bursts when alternate capacity is not available. The benefit gas generation has over coal is its ability to switch on and off, responding quickly to demand. The difficulty will be making an economic case to build an asset where the likelihood of dispatch is low. Take the Government’s decision to support the Kurri Kurri gas peaking plant which had forecast in its EIS to have a capacity factor of 1-2% for its $600m 660MW plant.

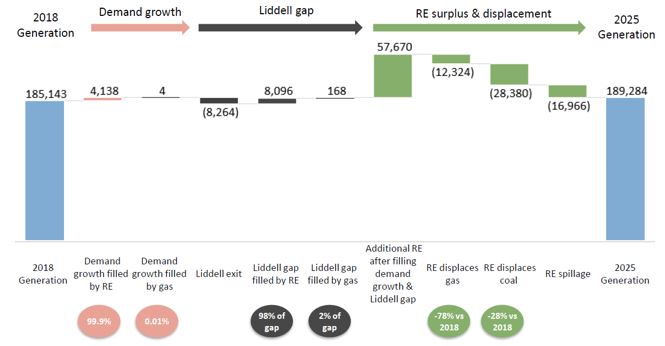

The net effect of these trends is neatly summarised in the diagram below which shows IEFFA’s expectation of a 78% and 28% reduction in gas and coals contribution to energy supply between 2018 and 2025.

Changes in energy supply and demand 2018 to 2025 (GWh)

Source: IEFFA.org – Australian Electricity Markets Overview & the Role of the DER

Even without an explicit price on carbon, the economics of running a coal plant are becoming stretched. The vertical integration into centralised baseload coal generation that, in the past, lowered portfolio risk for the energy utilities (balancing supply and demand), and for a period of time delivered superior returns, looks incompatible with a world transitioning to lower carbon emissions.

According to the Australian Energy Regulator, around 15% of the coal generation capacity that existed in Australia in 2010 has since been retired, and a further 29% is scheduled to retire by 2035. Although plant closures are ongoing, with coal generation representing close to 70% of output and about 50% of capacity, replacing these aging generators will require significant investment.

As each individual coal plant represents a large portion of supply, an exit has the potential to lead to price spikes and blackouts if sufficient reserve capacity is not available at that moment in time. This is what we saw with the Hazelwood exit which came at short notice for an industry requiring long lead times on investment.

Factors slowing investment

With solar and wind becoming increasingly dominant in the energy mix, it is new dispatchable capacity that will be required to fill the gap. There are several factors discouraging investment.

1. Uncertainty around the timing of the exit of coal

The profitability of investments in new dispatchable capacity often hinge on a coal plant exit occurring. Greater certainty on this front, lowers risk and aids the investment case.

2. A competitor existing the market can lead to short-term price spikes

A case of who blinks (Hazelwood closure) or attracts the government subsidy first (Yallorn recently received VIC State support to remain open for longer). Arguably, existing owners have an information advantage on this front but equally the Gentailers face their own complexity matching exits to replacement capacity.

3. Government intervention, building and underwriting new supply

The example here is Snowy 2.0’s 2000 MW of generation which is scheduled to come on in 2026, as it erodes some of the market opportunity for generation that may have been able to enter sooner. This situation has been further compounded by the Federal Government’s recent decision to support the 660MW Kurri Kurri peaking gas generator.

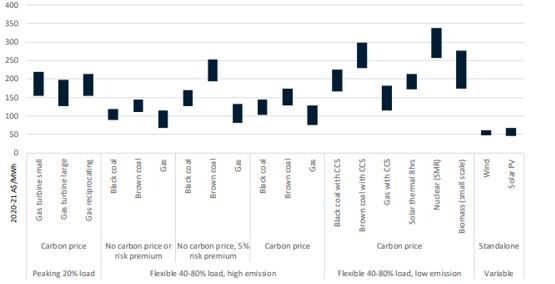

4. Evolving technology and scale will reduce costs over time

This raises the risk new investments are displaced by lower cost generation with time. The falling price of solar and wind contracts has already seen AGL impair its out of the money renewables contracts. There is also an expectation of an eventual lowering in the cost of green hydrogen as the cost of its two key imports falls: renewable energy (via technology and lower funding costs); and, electrolysers (through manufacturing scale). The global weighted average levelised cost of electricity from utility-scale solar PV’s declined 85% from 2010-20, while onshore wind power costs fell 56% during the same period[1]. The current market structure does not always reward the early adopter.

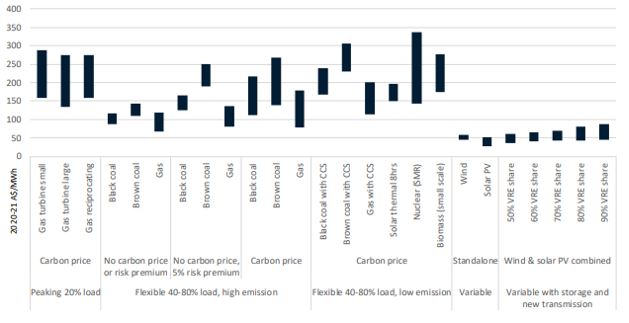

CSIRO Levelised Cost of Electricity by Technology and Category for 2020

Source: CSIRO GenCost 2020-21 Consultation Draft

CSIRO Calculated Levelised Cost of Electricity by Technology and Category for 2030

Source: CSIRO GenCost 2020-21 Consultation Draft

Summary

Climate change is a significant risk for the Energy Utility sector and industry participants have been caught in the crosshairs. On one hand they face shifting government requirements and consumer preferences on carbon, while on the other, falling demand and technological change have made the way forward difficult to navigate.

It is our belief that as generation becomes less centralised, the role of the energy utilities will be more one of coordination. The future of energy retail is likely to be behind the meter, controlling and coordinating demand with increasingly disaggregated storage and generation. The move is lowering the previously high barriers to entry and therefore, the likely returns outlook for the sector.

Carbon emitters are seeing higher costs of financing and insurance as the pool of investors available for these projects shrinks and/or seeks higher compensation for assuming climate risk. The Renewables 2021 Global Status Report highlights that public sentiment is rapidly turning against fossil fuels with Public and Private institutional investors worth nearly US$15 trillion committed to divestment as of early 2021. Access to insurance is also becoming more difficult, with many of the large insurance companies in Australia committed to not investing in nor insuring any new thermal coal. This higher cost of capital effectively performs the role of a carbon tax, increasing the relative cost of carbon intensive generation versus the renewable alternatives. Our question for management teams and boards of the listed players is, have they done enough to engender trust with their consumers such that they have the social licence to succeed in a renewables world?

Note: WaveStone do not hold any exposure to the energy utility sector.

Important information

This material has been prepared by WaveStone Capital Pty Limited (ABN 80 120 179 419 AFSL 331644). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable, but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.

[1] Renewables 2021 Global Status Report