Quarter in review: December 2020

The Australian market continued to rebound, rising +13.8% over the December quarter. Overall, the market finished up 1.7% for the calendar year 2020 – an outstanding outcome given the sharp drawdown (down 23%) in the March quarter and after what was a banner year in 2019 (up 24%).

Energy, Financials and Information Technology all rallied more than 20% over the quarter. Within Financials, banks lifted on a better bad debt outlook and the Australian Prudential Regulation Authority (APRA) removing dividend caps going forward. Utilities and Healthcare dramatically underperformed as investors positioned portfolios for a higher growth environment.

The key developments during the quarter were:

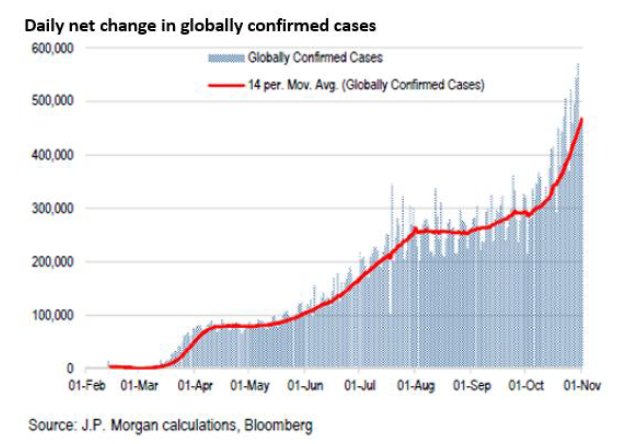

- Coronavirus second wave in full swing – The onset of the Northern Hemisphere winter brought with it a surge in new infections particularly in the UK, Europe and the US. Whilst fatalities and hospitalisation levels are lower, concerns remain that hospitals can be overwhelmed. To contain the second wave, lockdowns and curfews have been re-imposed in the UK, France and Spain. Lower mobility has meant that economic activity has slowed down. Stray cases of the virus in Sydney and Melbourne through the summer has resulted in localised shutdowns from time to time and some state border closures, highlighting the “stop-start” nature of the recovery. Globally, there has been over 95 million recorded cases and over 2m deaths related to the virus worldwide.

- Positive vaccine development – Pfizer-BioNTech, Moderna and Oxford-AstraZeneca released details on the overall effectiveness of their respective vaccines. Of these, Pfizer and Moderna have received Emergency Use Authorisation (EUA) approval from the US Food and Drug Administration (FDA) and European regulators whilst the UK and Indian regulators have approved the Oxford-AstraZeneca vaccine. The global vaccine rollout program started with almost 10m vaccines administered in December-20.

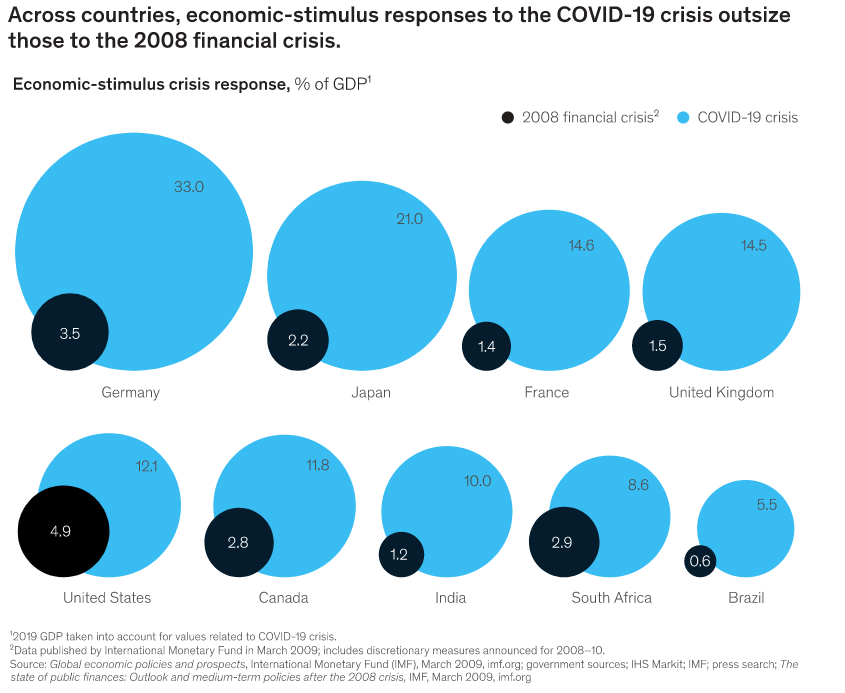

- US Elections – The Democrats led by President-elect Biden won a close election in November and subsequently also Congress and the Senate, giving the Democrats control of both houses. Markets have reacted strongly expecting that President-elect Biden will be able to quickly pass his new $1.9B stimulus bill to help the economy in 2021.

- Continuing easy monetary policy in Australia and around the world – The Reserve Bank of Australia (RBA) reduced the cash rate to 0.10% and announced a $100bn quantitative bond purchase program over the next 6 months targeting maturities of ‘around 5 to 10 years’. With rates close to zero, the RBA has now embarked on Quantitative Easing (QE) to keep financial conditions as loose as possible to facilitate the economic recovery.

- Fiscal largesse continues to underwrite the domestic economy – The Federal Budget was delivered in October, with the budget deficit expected to be 11% of GDP. Encouragingly this was upgraded in Dec (10 % of GDP) on a better than expected resurgence in economic activity, largely driven by increasing domestic demand despite the Victoria lockdown. Consumer confidence and house prices both rebounded in the quarter; the Westpac Institute Consumer Confidence improved from 93.9 in September to 112 in December.

- Australian dollar strength led by higher iron ore prices – The AUD resurgence has been helped by a meteoric rise in Iron Ore, 62% fines +35% over the December quarter – helping Australia’s terms of trade. Also, the expectation of a vaccine-led recovery in global economic growth has resulted in significant weakness in the US dollar. With the Biden administration announcing a further $1.9 trillion fiscal spending and the US Federal Reserve (the Fed) expected to continue its money printing, consensus expectations are for the US dollar to remain weak.

Source: McKinsey - Brexit deal signed – Britain and the European Union signed a deal in December. Several trade and regulatory changes are likely as a result of the deal. However, there are no immediate taxes or duties being imposed on goods being traded between the two areas. Rules related to travel, work and other services will see changes.

- Robust M&A & IPO activity – Corporate news was dominated by increasing M&A activity with takeover bids for Coca Cola Amatil, Link Group, Asaleo and Regis Healthcare whilst Bega announced it was purchasing Lion Dairy. Several IPOs also listed late in the year including Nuix, Adore Beauty, Hipages & MyDeal.com.au.

Detailed Fund commentary is available to our subscribers via the form below.