Quarter in review: June 2019

The Australian equity market was the standout performer globally over the June quarter up 8%, strongly ahead of the US market with the benchmark S&P 500 up 4.3%, while emerging markets were the laggard with the MSCI emerging markets index only up 0.7%.

A number of specifically local factors drove this relative outperformance. Most significantly the Coalition’s surprise federal election victory in May was enthusiastically embraced by the market as it removed the risks associated with a number of disruptive policies proposed by the Labor opposition that would have threatened the status quo in investment and property markets. In addition, the Reserve Bank of Australia (RBA) moved to ease official interest rates, meaning monetary policy would complement the fiscal stimulus from the impending tax cuts. In addition, surging iron ore prices will provide a material boost to the immediate Budget position and at least a short-term earnings bonanza for Australia’s major miners, including BHP, Rio Tinto and Fortescue Metals Group.

At a sector level the strongest performer was Banks, up 13%, enjoying a post-election relief rally as fears over negative imputation credit changes and negative property policy were removed. In addition, Communication Services was up 13% boosted by the ongoing bond rally and Healthcare was up 11%, as investors sought out duration and secular growth. The worst performing sectors were Energy (+1%) held back by a slightly weaker oil price, while Utilities (+2%) and IT (+4%) were also relative laggards. Interestingly the Energy sector is the only sector trading below its 15-year historic average multiple.

The key developments for the quarter were:

- RBA rate cuts – Almost unprecedented action by the RBA with two 25bps cuts in consecutive months, placing the official rate at 1.00% The rationale being that the Australian economy continues to stutter with below trend economic growth as evidenced by the March quarter at 1.8% and the RBA’s key target of inflation (May 2019 1.8%) sits stubbornly below the RBA’s target range (2-3%).Unemployment levels have stalled at 5.2%, however the RBA is concerned that the fall in house prices has seen the housing construction sector roll over, and as a major employer this could cause an unwanted uptick in unemployment and put more pressure on consumer confidence.

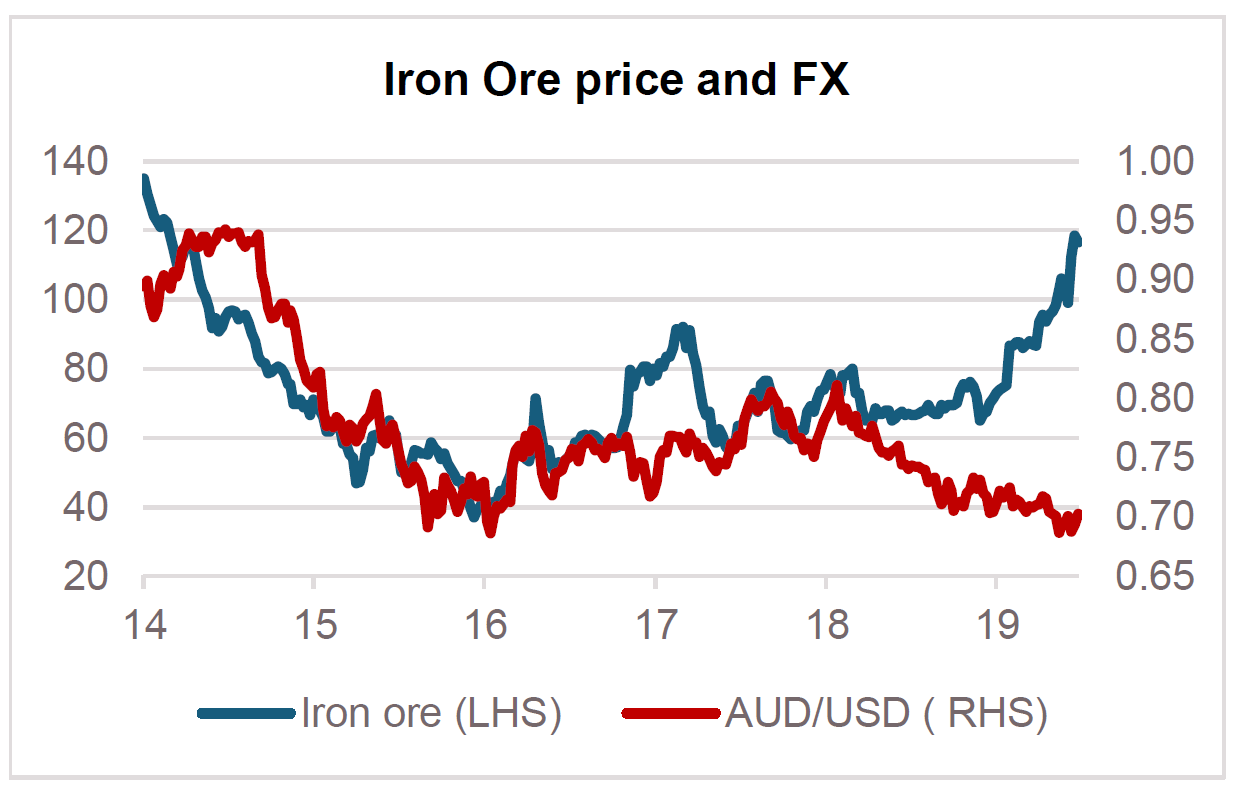

In addition, the RBA is concerned about the relative value of AUD, noting the breakdown of the historic correlation with the iron price as shown in the graph below. Should the AUD appreciate, either following the surge in the iron ore prices or due to changing interest rate differentials if the US Federal Reserve (Fed) cuts rates further, this is likely to hamper local economic growth.

- Iron ore price reaches 4-year high – the iron ore price surged 34% to $115/tonne as ongoing supply issues with Vale’s Brazilian operations and strong Chinese steel demand has caused dwindling port inventories.

Source: IRESS

- Australian Federal election – The surprise election win by the Coalition saw a +1.7% one day jump in the local equity market as investors, much like the broader population, had believed the polls and partly priced the negative effect of Labor’s proposed changes to franking, capital gains tax and negative gearing.

- Trade wars – Progress in the resolution of USA / China’s trade war ebbed and flowed after indications of progress early in the quarter, in May President Trump indicated talks were moving “too slowly” and raised tariffs on USD 200 billion of Chinese goods from 10% to 25%. China retaliated by hiking duties on USD 60 billion of US goods. Thereafter at a meeting at the G-20 in Japan, Trump and Xi agreed to continue negotiations, but as yet little tangible progress appears to have been made. Tensions remain heightened with the US and its allies blacklisting China’s largest telco equipment maker, Huawei. To offset the weakening Chinese economic data there were further stimulus moves to improve bank liquidity and support local government infrastructure.

- Dovish Fed – The US market continued to hit new highs as the Federal Reserve signalled its willingness to cut interest rates from its current 2.5% following weaker than expected non-farm payrolls data with 75,000 new jobs in May. The S&P500 was up 3.8% for the June quarter whilst the Nasdaq stock exchange was up 3.6%. Bond yields globally continued to decline due to the weaker economic data with the US-10 year below 2% whilst Australia’s 10-year hit a new low of 1.27%.

- Brexit – The Brexit saga continues with the resignation of Theresa May as UK Prime Minister putting in play a lengthy battle to decide the new leader of the Conservative party. Despite the ongoing uncertainty, the FTSE 100 Index was up 3.3% during the June quarter.

Detailed Fund commentary is available to our subscribers via the form below.