Quarter in review: September 2019

The Australian equity market continued to move higher over the September quarter up 2.6%, with the positive support from central bank rate cuts outweighing concerns over slowing global economic data. Beyond the relative valuation support of falling interest rates, equity investors appeared willing to pay a scarcity premium for rare growth stocks in the prevailing low growth world, and chase yield from cash generative assets. While in the background the ongoing China US trade war and Brexit stalemate, both remain an impediment to world growth. The local market did continue a period of outperformance versus the US Market with the benchmark S&P 500 up 1.2%, while emerging markets continued to lag with the MSCI emerging markets index down -0.5%.

At a sector level the strongest performers included Consumer Staples (+12.2%), and Healthcare (+7.3%), both perceived as offering investors lower risk, defensive earnings. Somewhat paradoxically investors also bid up Consumer Discretionary stocks (+9.6%) on expectations of that lower interest rates and tax cuts underpin the consumer confidence and lift sales. Underperforming sectors included Communication Services (-3.4%) after a soft result from Telstra, as well as Materials (-2.8%), & Energy (+0.4%), weighed down by softer commodity prices and global growth expectations.

The key developments for the quarter were:

- RBA rate cuts in July (and subsequently again in early October) to a new low of 0.75% amounting to three rate cuts so far in 2019. As the global economic data deteriorates the RBA is mindful that Australia is an open trade economy with a yield sensitive currency, that would have more than likely appreciated if not for rate cuts. Domestic data remains positive but below trend justifying the RBA’s stance. GDP growth for the June quarter was anaemic at 1.4%, the unemployment rate rose slightly to 5.3% and the RBA’s key target of inflation (June 2019 1.4%) still sits below the RBA’s target range (2-3%).

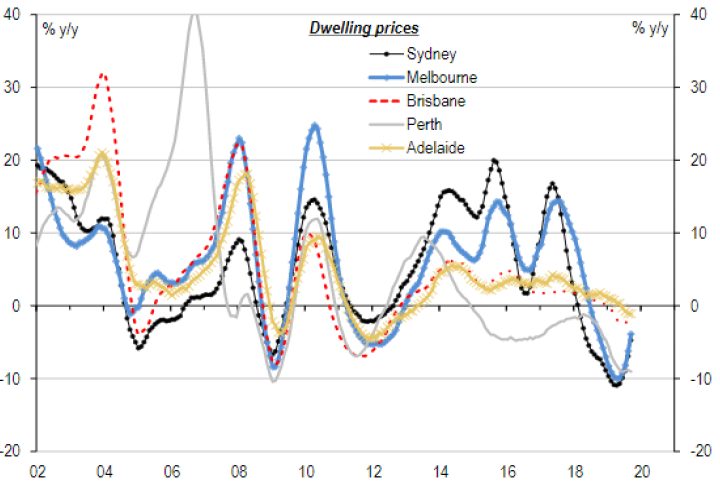

- Emerging positive house price growth in the key Sydney and Melbourne markets is seen as a positive development after two years of decline. In May, APRA announced the loosening of credit conditions with serviceability interest rate test lowered from 7.25% to 2%above the standard variable rate. Both Banks and mortgage brokers have seen solid increases in applications for mortgages, however responsible lending laws applied to SME lending is still hampering business credit growth.

Source: ABS, Core Logic, UBS

- Iron ore prices declined from highly elevated levels of US$115/t to US$93/t with Chinese speculators and traders impacted by the falling Chinese currency while supply constraints eased as Vale’s Brazilian operations recommenced operations and Chinese steel demand slowed. Elevated iron ore prices have clearly boosted the Federal government’s budget with the Treasurer announcing a projected surplus for FY20. Notwithstanding the recent retracement, the iron ore price remains well above long term forecasts and at current prices this should mean strong operating margins and big dividends from the major miners

- Income Tax cuts flowed through with retailers seeing a lift in sales growth however further fiscal stimulus may be required to boost the economy given the worsening East Coast drought.

- August Reporting Season modestly disappointing. The final scoreboard for the FY19 reporting season for Australian corporates revealed only modest EPS growth of 2.5%. Strong commodity price driven EPS growth of 21%growth from the resources sector, was offset by weakness across the Banking sector and domestic Industrials. At a stock level, strong results from CSL, ResMed and Treasury Wine were among the highlights of reporting season whilst disappointing results included Boral, Cimic and Orora.

- US Federal Reserve (Fed) cuts rates for the first time since the GFC. The Fed cut interest rates 25bps in July and again in September in response to the worsening global economic data. They did note that monetary policy cannot combat the impact of trade wars. The European Central Bank (ECB) fired its last substantial bullets with the September return to quantitative easing (QE) and extension of negative interest rates.

- Oil price imp acted by geopolitical events but lower global growth drags. Saudi oil fields were hit by drone attacks on September 14th cutting out 5.7mb/d or ~5% of the world’s global oil supply. The oil price surged intraday 20% but has since retraced. Despite the heightened geo-political risk, Brent and WTI crude declined 8.5% and 5.8% respectively over the quarter, weighed down by lower economic growth.

- Chinese economy continues to slow with industrial production growing at 4.4%, down from around 7% in early 2018. Retail sales also slowed, to 7.5% from nearly 10% in early 2018. Chinese exports fell in August by 1%yoy and by 16% to the US – a clear sign that the dispute with the US is tangibly hurting bilateral trade. However, it’s still far from clear that China will concede to the US trade demands, for now preferring to cut tax rates as well as lower interest rates for the banking sector in an attempt to stimulate domestic demand.

- Brexit, the saga continues with new Prime Minister Boris Johnson losing out to the parliamentary majority as it passed legislation that will force the government to request an extension if it can’t agree a deal with the EU. The current deadline is scheduled for October 31st and it is a coin toss as to whether there will be a resolution and agreement or whether it amounts to another “kick the can” postponement. A new election remains a possibility.

Detailed Fund commentary is available to our subscribers via the form below.