Quarter in review: September 2020

The Australian market was flat for the quarter with small caps especially IT and consumer discretionary sectors providing positive returns whilst the energy, utilities and financial sectors continued to fall. The quarter was again dominated by the COVID pandemic and its impact on lives, livelihoods, politics and economies. We discuss some of the events that occurred during the quarter:

- Coronavirus – COVID19 cases continued to climb as the Northern hemisphere enters Autumn and the virus case count surpasses 35m. The race for a vaccine continues and any positive news around timing moved global stock markets over the quarter. The medical community has done an outstanding job on limiting the death rate from the disease as knowledge is shared about treatment and therapeutic drugs. The impact from restrictions and closed borders continues with Melbourne experiencing one of the longest and strictest lockdowns globally.

- Commodities prices continue to rise, except for oil – Gold hit a record on 6th August at US$2069 as the record government deficits globally require negative real interest rates to finance them. The actions of central banks to drive real rates lower makes cash and government bonds less attractive and gold is of course seen as an alternative safe haven asset. China’s recovery is ahead of the rest of the world with minimal cases, the government is stimulating economic growth increasing its demand for iron ore with the price up 24% over the quarter. Global iron ore supply remains constrained by Vale’s mines being impacted by the large COVID19 case count in Brazil. Brent Crude Oil was volatile throughout the quarter but finished largely flat at US$40.95.

- Global markets outperformed Australia – Globally the MSCI world index was up 8% whilst our AUD was up nearly 4%somewhat offsetting this move. The technology stocks carried stock markets globally with the Nasdaq up 11% peaking in September before a long overdue pullback. The US election continues to dominate the headlines with polls and the odds pointing to a Biden win despite Trump contracting COVID19. Economically the JPMorgan Global Purchasing Managers’ Index fell for the first time in five months in September, dipping from 52.4 in August to 52.1, but remained in positive territory to merely indicate an easing in the rate of expansion.

- Australia is in a recession – The Australian economy contracted 7% quarter on quarter (qoq) in June quarter entering a recession for the first time since 1991. The key economic indicators were mixed held back by the Victorian lockdown which the Reserve Bank of Australia (RBA) estimates took 2%from GDP in the September quarter. Hours worked were down 10% to May 2020 have subsequently improved by 6%; the unemployment rate positively surprised at 6.8% as at August and retail sales after rising strongly in June and July fell 4% in August.

- Cash rate remains at 25bps – The Reserve Bank of Australia kept the cash rate and the three year government bond yield target at 25bps over the quarter but there is an expectation that the cash rate could move to 10bps. The RBA continued to expand its balance sheet to over $300bn by funding the banks at 25bps via the Term Funding Facility (TFF) to allow the banks to retire wholesale funding and support the economy via lending to households and mortgages. We are seeing investors starting to borrow again with housing finance data for August ex refinancing’s up 19.3% yoy with both owner occupied (+14%) and investor lending (+9%).

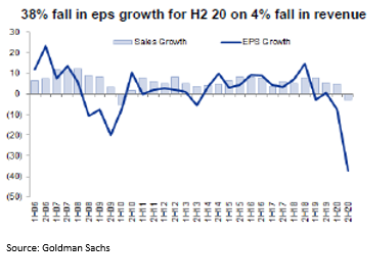

- August reporting season was subdued – EPS fell 38% in the H2 (second half) on a 4% fall in revenue, with most of the damage in the June quarter (see below) and very few companies provided 2021 guidance given the uncertainty. Companies conserved cash, slashing dividends with some raising equity to provide cushion to balance sheets.

- Capital market activity – Equity raisings continued over the quarter led by Sydney Airport’s $2bn and Tabcorp’s $600m to bolster balance sheets whilst Corporate Travel raised $375m to acquire the North American TMC, Travel & Transport group. Other M&A activity restarted with the TPG and Vodafone merger closing after the court ruled against the ACCC blocking the merger and IOOF acquired NAB’s MLC wealth for $1.44bn and raising $1bn equity.

- ESG in the spotlight – ESG related news in companies we don’t own include AMP’s promotion of a senior male executive despite a sexual harassment claim, QBE CEO’s reported inappropriate behaviour and subsequent departure, Cleanaway’s widely publicised cultural issues stemming from the CEO and finally Crown has been a fascinating insight into a major non-controlling shareholder’s control over its board.

Detailed Fund commentary is available to our subscribers via the form below.