The Big Australian is about to get bigger!

It’s certainly been an eventful couple of weeks for the Big Australian. On-top of releasing the strongest results for some time and confirming the go-ahead for its Jansen Potash project, BHP also announced that it would merge its Petroleum business with Woodside via an in-specie distribution to current shareholders and also released a proposal to unify its current corporate structure from its current dual listed structure (DLC) into a single company listed on the ASX.

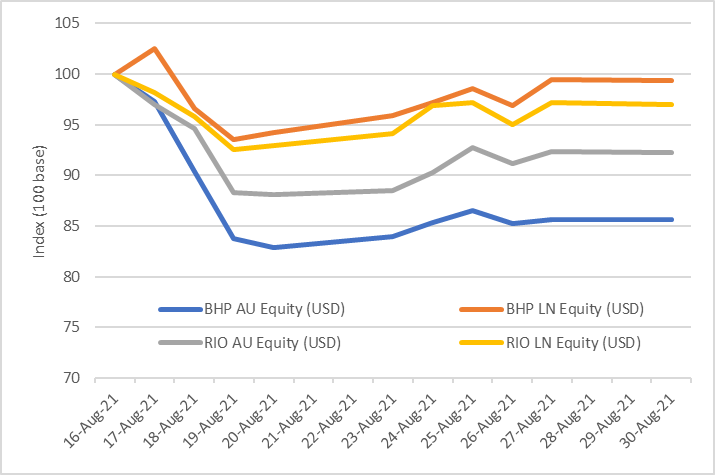

Of the above elements, in our view, the unification proposal has had the greatest impact on BHP share price performance so far. We can see that in Charts 1 and 2 where the Australian listed shares (Ltd) have underperformed by 15% in USD terms versus that of its UK listing (Plc) and fellow diversified miner RIO Tinto on both bourses as investors have repositioned themselves ahead of the upcoming restructure and closed the spread between the DLC and Plc shares from around 20% to 5% today.

Charts 1&2: BHP Ltd has under-performed since the unification proposal as the spread between Ltd and Plc has contracted materially

Source: Bloomberg

Why was there a spread and why did it close?

The dual listed company (DLC) structure was set-up some 20-years ago in June 2001, when BHP Ltd merged with Billiton plc and formed the BHP Billiton group (now renamed BHP Group). The merger maintained separate legal companies, that kept their primary listings on the London Stock Exchange (LSE) and Australian Stock Exchange (ASX) but operated as a single unified economic entity, with the combined economic benefits including dividends shared on a 1:1 basis between both shareholding groups.

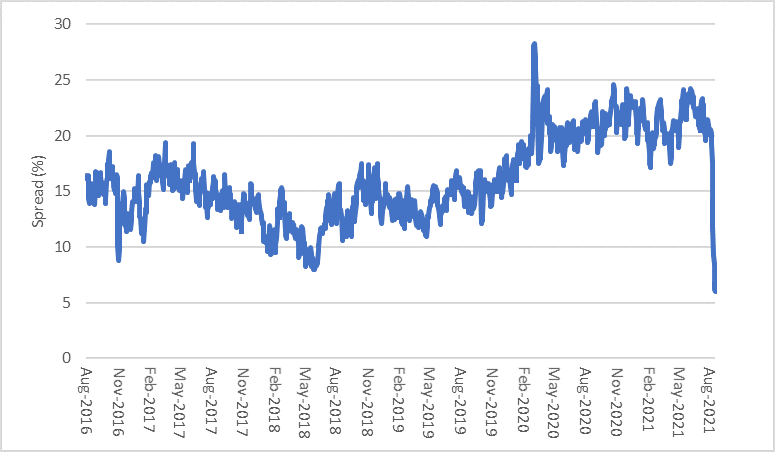

The economic sharing agreement as described above means that the valuation of the overall company for both Ltd and Plc shareholders should be the same. However, in practice valuation differentials have arisen between both listings due to (1) currency differentials between BHP’s functional USD currency and the GBP and AUD and (2) imputation or “franking” credits that accrue to Ltd shareholders but not Plc ones.

- Currency differentials matter, as the USD company valuation of BHP’s future cashflows are impacted by the current or expected value of USD/GBP or AUD/USD exchange rates. Periods where the market takes a bearish/bullish view on currencies has led to the spread contracting or widening.

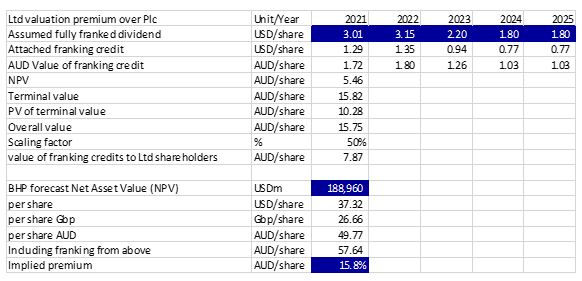

- Imputation credits provide additional credits to holders of Ltd shareholdings that can access franking credits. A marginal buyer of BHP Ltd with an Australian tax residency and marginal tax rate of say, 15%, is in a more advantaged position buying Ltd shares on the ASX vs. Plc shares on the LSE, all else equal. While not every shareholder of the ASX-listed BHP falls into the above category, we understand that 50% or so are domiciled in Australia. It’s also arguable that the marginal buyer does value franked dividends, particularly in periods leading up to dividend payments or other capital management initiative such as an off-market buyback. Assuming 50% of the Ltd shareholders value the franking credits and using consensus dividend estimates, we estimate the premium for Ltd over Plc should be around 15-16% A level equal to the long-run observations of these premia in the market.

Table 1: Franking credits and currency movements drive the BHP Ltd and Plc spread.

Source: Bloomberg consensus estimates

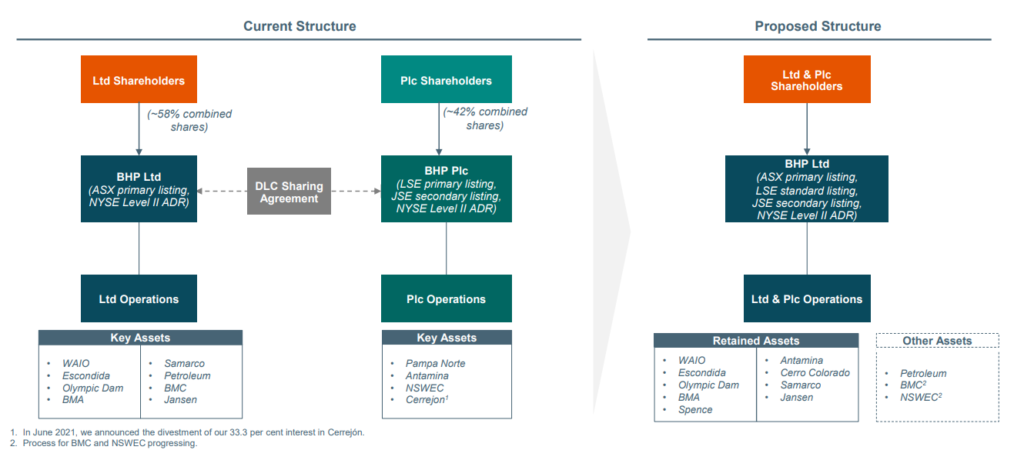

BHP’s unification plan involves a UK scheme of arrangement whereby BHP Ltd would be acquired by BHP Group Plc by consideration of shares on a 1:1 basis as set out in Chart 3. This means on completion of the proposed unification, the valuation differentials between Ltd and Plc as described above would cease to exist as equity would be valued in AUD dollars only and franking credits distributed by BHP Ltd would accessible by all shareholders.

Chart 3: The pre- and post-unification corporate structure for BHP Group

Source: BHP Group

Thus, given this new information, the market immediately closed the prior valuation mismatch by selling BHP Ltd shares and buying Plc shares to a level where the current spread only reflects the small risk of unification not being agreed. The upside accruing to Plc shareholders was material, versus the negative experience of the Ltd shareholders.

But that’s just the start

That said, we have only started the journey for unification and the challenge from here will be for BHP to explain the upside of the unification, versus the share price reaction and $500m implementation cost. We highlight three areas of focus (1) retaining credits (2) increase corporate flexibility from a single listing and (3) significant upweight of BHP’s Ltd Index weighting.

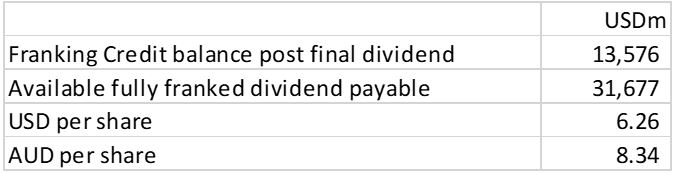

Franking credits: The DLC Dividend share

Traditionally, there hasn’t been a question of BHP maintaining its franked dividend status, given the company’s large and profitable Australian asset base and significant store of franking credits. Presently, BHP’s franking account stands at US$14b, which would enable a fully franked dividend of A$8.34/share. Moreover, on an annual basis, franking generation has been strong, aided by the dominant earnings stream from Australian Iron Ore Assets.

Table 2: BHP’s franking account

Source: BHP Group

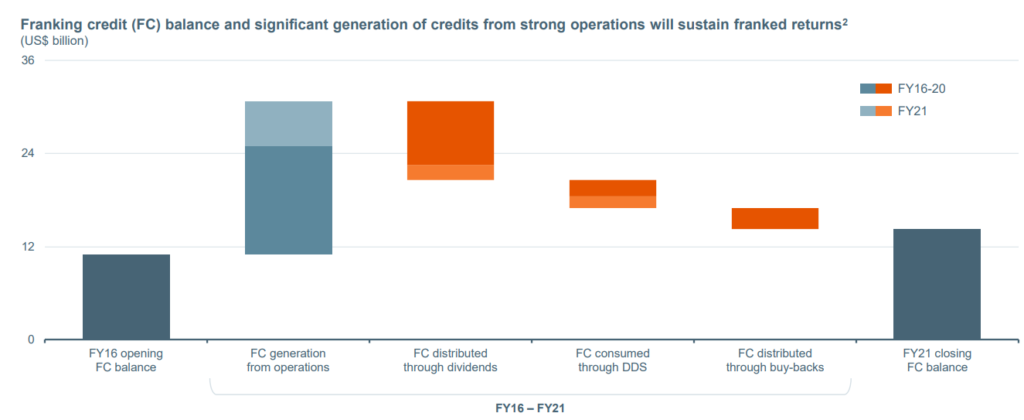

However, many of these franking credits are currently wasted due to the requirement for BHP Ltd to subsidise its Plc shareholders’ dividends under the DLC Dividend Share. This mechanism was introduced by BHP in 2016 to assist with dividend matching between BHP Ltd and BHP Plc. BHP Plc doesn’t have the capability to fund its annual shareholder dividend due to the diminishing contribution from assets held within BHP Plc that only contribute 5% of group net earnings. As an example of the “lost franking”, in FY21 we estimate that of the US$3.4b franking credits distributed by BHP, only US$1.9b were distributed to Ltd shareholders and US$1.4b was wasted by utilising the DLC Dividend Share to subsidise dividends paid to Plc shareholders.

Chart 4: BHP’s franking account journey since 2016 (excluding FY21 final dividend)

Source: BHP Group

In a setting where BHP’s profit generation shifted, rebalancing away from Australia (e.g. contracting iron ore and coal prices from Australian assets and higher copper and Potash Prices in overseas assets) the existence of the DLC Dividend Share would exacerbate the wastage of BHP’s franking and potentially lead to the company running out of credits.

While we don’t envisage the above situation playing out today, a real life one is playing out as we speak that could erode BHP’s franking position.

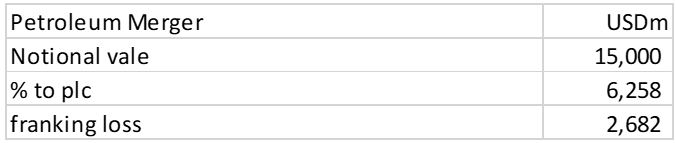

The live example of the demerger of BHP’s Petroleum business is a good example of how the DLC structure impacts BHP’s franking account through the DLC Dividend Share. Under the current proposal, BHP would merge its Petroleum business (owned by BHP Ltd) with Woodside. Consideration would be Woodside scrip that is passed directly to BHP Ltd shareholders. Given unification had already occurred, the franking credits of BHP would be kept whole.

Under the alternative scenario, if the merger were to occur under the current DLC structure, BHP would need to distribute 42% of the Woodside scrip to Plc shareholders as a dividend (using the DLC Dividend Share) which would utilise precious franking credits in the process. Assuming a value of $15b for the sale, BHP’s franking credit account would fall by 20% or roughly US$2.7b in that scenario.

Table 3: BHP’s franking account would be impacted significantly if Petroleum were demerged without unification

Source: WaveStone Capital

While these illustrative example highlights the benefits of unification on BHP’s ability to retain franking credits for its shareholders, there’s no way of valuing this benefit from a monetary perspective. In the steady state scenario, whereby foreign based Plc shareholders simply kept all their Ltd shares on unification, franking credits now available wouldn’t be utilised and were wasted anyway. However, in our view, on balance, the ability for BHP to ‘save’ more franking credits under unification and also the status of the marginal investor being an Australian resident will maintain BHP’s attraction for investors in the future.

Corporate Flexibility

Over the long-term, unification will increase flexibility for BHP. Presently the DLC structure prevents roll-over relief for scrip-based offers for M&A transactions that have US shareholders, a factor which increases the company’s cost of capital and places it on a less competitive footing versus peers who enjoy that advantage.

Further, complications around capital management reduce significantly, removing pricing difficulties that occur under rights issues with regard to the Limited and Plc share-prices. Post-unification, any rights issue will involve an issue of shares (with a single trading price) to one set of shareholders.

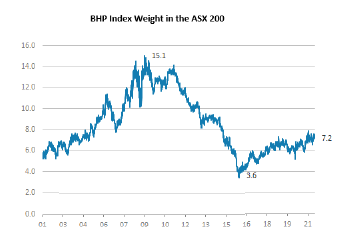

Index Weighting

If the unification vote, scheduled for 1HY2022, meets the required 75% approvals by shareholders, there will be A$100b of new BHP shares quoted on the ASX. This will mean that BHP’s index weight will likely go up to 11%, making it the largest company in the ASX (CBA’s current index weight is 8.3%). Our analysis of the local register suggests that roughly one third of the shares are owned by Australian retail shareholders. The institutional component is 60% owned by local institutions and 40% by foreign holders. Approximately 20% is owned by Index funds either based in Australia or overseas.

The Plc register split differs from the Australian and whilst rudimentary, our analysis indicates that Australian investors will be required to absorb a flow of stock, although the size isn’t as big as feared.

We understand the register split is around 6% retail and 94% institutional. Of the institutional register 25% are FTSE benchmarked active managers, 16% are FTSE Index Managers, 6% are MSCI Index Funds and the remaining 47% we assume are global active managers. We estimate that net demand for Index funds will be higher once BHP unifies, given the higher weighting in Australia of these types of funds. However, for MSCI Index investors, the net impact will likely to be neutral as BHP will retain its current global MSCI weighting. The decision factor for global active managers to continue holding Ltd shares will be on the relative value of BHP compared to peers such as RIO Tinto, Anglo American etc.

This leaves around 30-40% of Plc existing shares that may need to be absorbed by the Australian market if they aren’t held on to by existing shareholders. The short-term impact of the additional supply of shares will likely mean that institutional investors will have to absorb the shares. This is likely to have a dampening effect on the broader market given it will be funded by selling other holdings.

Chart 5: BHP Index Weight

Source : Morgan Stanley

BHP has had a higher index weight in the past (15.3 in February 2009) and therefore, we expect these benchmark related issues to wash through over time.

Overall, we acknowledge that the valuable nature of franking credits in the hands of Australian-based investors will lead to demand for BHP scrip (to the extent that it can be franked) and as such the valuation of BHP will trend towards a holistic assessment of the combined franked cashflows of the company in a similar way it does to other solely listed Australian stocks.

The Petroleum demerger also has implications for BHP, although the impacts will be felt over a longer period.

The rationale for the deal

BHP’s change of strategy regarding the “fit” of its Petroleum business within BHP overall is driven much more by the rapidly changing cost of capital for the oil and gas sector than the quality of the underlying business being sold. Indeed, we believe that the portfolio contains high quality current growth assets such as the Gulf of Mexico Oil business, mature cash generative assets such as Bass Strait and the North West Shelf and optionality through development assets of Trion and Calypso. Further, the business generates strong free cashflow and adds diversification benefits to BHP’s portfolio by reducing the correlation to Chinese growth.

The move to demerge, reflects BHP’s view that these benefits are increasingly likely to be overwhelmed by the increasing cost of capital that oil and gas businesses face as society looks to decarbonise. As such, the overall equity value for BHP would be de-rated as long as they owned it. This was already evident in the UK market, where Rio Tinto traded at a considerably lower discount to its Australian listing compared to BHP. Rio has no direct exposure to fossil fuels.

With a view to exiting the business, BHP either could have looked to sell its portfolio in a piecemeal fashion, demerge it as a standalone entity or seek a merger with another party. In our view, a piece meal asset sale approach would have been sub-optimal given the time taken to realise value and the risk that BHP would be left with unwanted assets. A demerger via an in-specie distribution to all shareholders would create a mid-tier global producer allowing the market to discover its true value. While a merger with an established player would add scale to the combined entity, questions around value realisation would remain outstanding.

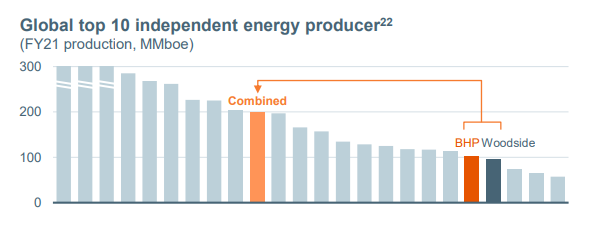

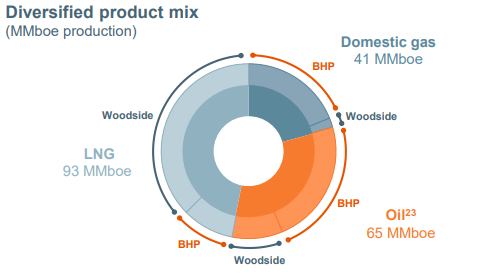

BHP have taken the view that size will be of essence in transitioning the business to a world committed to net zero by 2050. Hence, it chose a hybrid solution via a proposal for Woodside and BHP to merge their businesses. Under the transaction terms, Woodside would acquire BHP’s petroleum business and issue Woodside equity to BHP shareholders as consideration. The deal would see BHP shareholders owning 48% of the new enlarged company and values BHP equity at US$15b on a net basis. This value appears slightly lower than our estimate, although we haven’t had full disclosure on the deal terms including the closure liabilities being transferred over from BHP. We would also suggest that Woodside’s implied NAV at the time of the deal was below our estimate. Valuation considerations aside, the combined business would have 200mmboe of oil and gas production, equivalent in size to a top 10 global producer. Moreover, gearing would be at circa 12%, a desirable outcome in a world where accessing capital appears increasingly difficult.

Charts 6&7: The merged BHP Woodside Petroleum business would be significant on a world scale

Source: BHP Group

That said, the deal faces some challenges. In the near-term, Woodside shareholders will be required to approve the deal, with a 50% approval threshold required. The deal conclusion is expected to be in Q2 of 2022. While register churn post the deal is hard to predict, given the enlarged register will contain existing BHP shareholders, they will likely be net-sellers of the new business, particularly those in Europe. While the enlarged domestic register will attract buyers (especially index funds). Over the longer-term the success of the combined business will be steered by a new board and management team.

Author: Duncan Simmonds, Senior Investment Analyst

This material has been prepared by WaveStone Capital Pty Limited (ABN 80 120 179 419 AFSL 331644) (WaveStone). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.