The long and short of it: identifying shorting opportunities

WaveStone Capital takes an active high conviction approach to investing in quality Australian companies. The fundamental based analysis leads to identifying quality companies with superior corporate DNA. When conducting their analysis, the team also uncover companies that have less favourable traits and/or are overvalued. As a general rule WaveStone prefers to short weaker businesses facing deteriorating industry headwinds rather than higher quality businesses that may be overvalued.

In this latest update, Graeme Burke talks to WaveStone’s approach to shorting, along with a number of examples the team has recently identified.

We do not believe our investors are best rewarded by taking aggressive and highly public crusades against identified short positions. In our assessment, this approach could be construed as more about manager self-promotion than maximising investor returns.

Instead we seek to thoughtfully and dispassionately undertake our analysis, often acting away from the limelight of the crowded “consensus” trades, then aiming to move quietly with the stealth and precision of a ninja assassin. We will not deploy individual shorts to pander to our ego or vanity, rather we will deploy our resources when we see opportunity. Such opportunity emerges when our fundamental research identifies weak and challenged businesses, deteriorating industry environments or valuation bubbles. There may in fact be times or market conditions when we cannot identify much opportunity to add value, however in recent times we are identifying a range of opportunities.

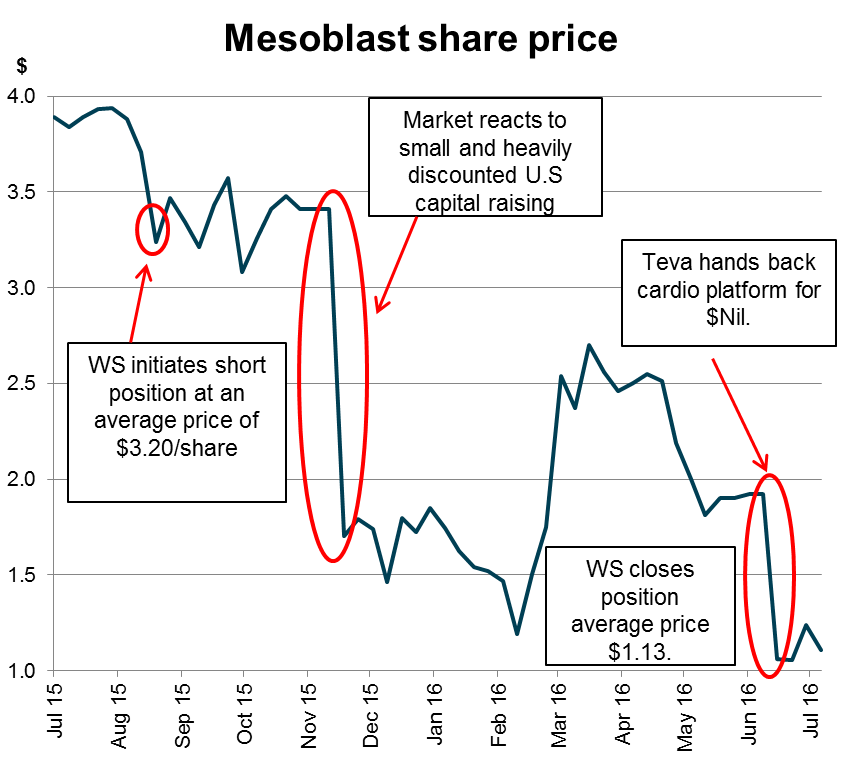

As a general principle, WaveStone have sought to be open and transparent in our disclosure with our investors. Accordingly we will seek to share with our investors, especially through the quarterly reports, more granularity and insight into the WaveStone Dynamic Australian Equity Fund’s shorting activity. However, we assess the best outcome for our investors is to be more circumspect when we are first establishing individual shorts, and provide more post mortem analysis once a short thesis or event has played out or has been crystallised. By way of example, in last quarter’s report we showcased the rationale and timeline of our short position in Mesoblast. We are pleased to confirm the short was closed out in July at an average price of $1.13, locking in a gain of >60% in less than twelve months. Not all shorts can be expected to be this successful, however we remain confident of adding value across the short basket.

With the overall Australian equity market up over 5% in the September quarter, adding value from individual shorts was more challenging.

Notwithstanding these conditions, the Fund added around 50 basis points of value from its small (approximately 5% of capital) but targeted single name short positions.

Aged Care operators under the microscope

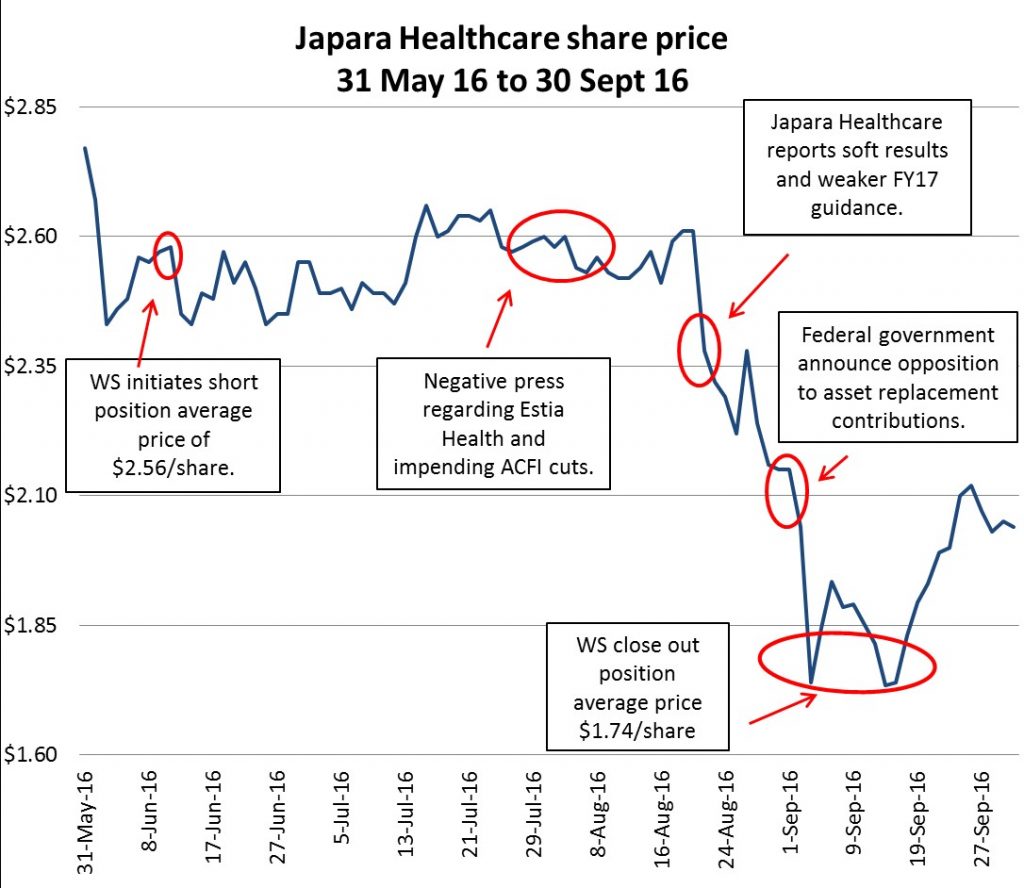

In June we identified listed operators in the Aged Care or Nursing Home sector as being susceptible to both a de-rating and ongoing earnings pressure following a raft of Government funding changes. By way of background, the stocks had little transparent operating history, with the listed vehicles created by disparate mergers and corporate restructuring, however the sector enjoyed a honeymoon period in the minds of investors.

The opportunity for corporatisation of a fragmented cottage industry, underpinned by strong demand from an ageing population saw the stocks initially enjoy very high Price-to-Earnings (PE) ratings. On closer examination we saw little evidence of the levels of sustainable organic growth to justify such a rating. We had experienced the sector struggle to generate adequate returns when listed over 15 years prior. Our analysis suggested earnings growth was being driven by PE arbitrage and gearing. Beyond financial alchemy, the next step of valuation creation was ”more efficient” management systems that blatantly and materially increased the government daily care payments, compared to the levels charged by charitable and more benevolent prior owners.

The Aged care sector is highly dependent on government funding with around 65% of revenue coming from the Federal Government via the Aged Care Funding Index (“ACFI”), a complex matrix system which sets a daily payment amount per resident according to levels of care as well as general health and cognition. Indirectly most residents are also required to pay almost all their pension to meet the cost of care. Over recent years the total ACFI payment by the government was growing well ahead of inflation due to the multiplier effect of the increasing number of aged care residents and higher average levels of care. In response to a worsening overall deficit and spiralling ACFI payments the government set out in its May 2016 budget, some significant changes to ACFI classification.

Although the immediate equity market was negative, deeper analysis and discussion with a leading unlisted operator and a range of industry consultants, served to help understand and calibrate the likely longer term cumulative effect of the regulatory changes on operator profitability, was being grossly underestimated. In broad terms the listed operators were generating approximately A$50-55 EBITDA per day for each resident. Once fully implemented, the proposed government changes are likely to impact daily profitability by A$10-20 per day, representing a major dent to operator profitability. In response, the operators have sought consultation with the government and also acted swiftly to creatively introduce a range of extra service and “asset replacement fees” to offset the threat to industry profitability. The government has questioned the legality of “asset replacement charges”. We question the affordability of “extra service charges” to the financially underprivileged, “concessional” residents (some 30-35% of aged care residents) or the value of High speed Broadband, Pay TV and wine to the large cohort of residents suffering from dementia.

Estia Healthcare has been the highest profile collapse in the sector. The entity was created through a merger of three businesses and an aggressive “land grab” acquisition strategy. The sudden exit of the sponsoring Private Equity investor straight after the 2016 Budget ACFI changes was followed by a raft of salacious press articles showcasing the expensive lifestyle and luxury car fleet of a vendor director and a shareholding allegedly entwined by a massive margin loan.

Source: The Australian

The business has succumbed to register turnover, director and management resignations and a series of profit warnings. Despite the attraction highlighted by the corporate governance shortcomings at Estia, we determined that ALL the operators were at risk to the deteriorating regulatory environment and established “less crowded” shorts positions in the other operators. While Estia’s woes and public humiliation served to shine a light on the industry’s problems, fundamentally weak 2016 reported results by all the operators and sector wide downgrades to future growth and ratings by the broker community, accelerated share price declines through into September. We gratefully locked in the gains of >30% in Japara Healthcare in a little over 3 months.

The question could be asked, “Would WaveStone consider buying an aged care operator?” Currently we assess too much regulatory uncertainty and consider the full impact of the government’s changes to ACFI classification and payment levels will take a couple of years to wash through the system. Longer term, there is undeniable demographic demand and variances in the return profiles between the best and the not so efficient operators – but we wrestle with the two big questions, “Are there more structurally attractive sectors to invest?” and ”Is aged care an area where society is better served by not for profit or social infrastructure investors?”

It is important to put in perspective the role of shorting in the Fund. We seek to deploy individual short positions to add incremental value to overall returns. We would still expect that over a full investment cycle, the bulk of returns will be generated from the Fund’s long positions.

Author: Graeme Burke, Principal and Portfolio Manager