Trends and innovation: investing in a world of disruption

WaveStone Capital’s Principal, Catherine Allfrey discusses some of the latest innovation trends that have the potential to impact many established companies on the Australian stock exchange. She talks to the importance of identifying companies that contain a culture of innovation and ability to change direction. This holds the key to differentiating between good investment opportunities and value traps.

Disruption and innovation is currently a hot topic across global investment markets. This is because the rate of change we are currently experiencing is accelerating within information intensive industries that impact our daily lives. There are many examples of disruption across the media, telecommunications and IT sectors. However the next transition of technological innovation will likely be in the form of artificial intelligence, robotics, mobility and the cloud which is likely to impact many broader based industries.

One such example of this technological innovation is artificial intelligence and augmented reality. This technology is attracting significant investment by the large technology firms.

In 2014 Facebook paid US$2 billion for virtual reality (VR) firm Oculus Rift and ever since we’ve been waiting to see why Facebook paid so much for a company without a single product. The launch was in April 2016 and so far, like many new technologies, it has been disappointing. Sony has recently launched its VR headset attached to its successful PlayStation to also disappointing reviews. Google and Apple are working with VR and the iPhone 8 launch next year is expected to have enhanced VR capability.

Although in its infancy, computerised self-learning algorithms and immersive technologies are already present in our day to day lives. Search functions on the internet, voice recognition in the smart phone, video image recognition in carparks and the autopilots in the planes we fly in are all examples. Other industries aligned to patient care, surgery and education are all likely to benefit from this technological advancement.

Along with any new innovation comes the opportunity to disrupt existing industries. A commercial concept that is currently ’under construction’ is the virtual shopping mall. A UK firm Trillenium is an example of a firm advertising the potential to shop online, go on virtual holiday or inspect a potential real estate investment with a virtual reality headset.

Source: www.trillenium.com

Disruption for traditional bricks and mortar retailing has been around since the internet was released for mainstream use. Initially management of shopping centre developer/owner/operator Westfield (ASX: WFD) were hesitant to change their operating model, but realised that to survive the disruptive threat and thrive longer term, they needed to evolve. They implemented a strategy and successfully demerged their Australian assets, sold 35 regional suburban malls in the US and recycled that capital into iconic buildings in global cities or their flagship mall strategy. The strategy has paid off with these flagship malls receiving more than double the sales and rent of regional suburban malls

Westfield obviously track their own malls but also monitor total US retail sales including all online companies like Amazon, Apple, Google and Samsung. Some interesting findings were.

- Amazon net sales of $US 17.7 billion is growing at 28% for the year to June 2016 which represents half of the consumer growth in US retail sales which was 4-5% per annum.

- Amazon accounts for 60% of all online sales growth.

- 50% of all transactions at Westfield centres are influenced by digital.

- 72% of customers bought online after browsing in-store. Shops are now showrooms.

- 78% of customers buying in store after browsing online.

Amazon recently announced they will be hiring an additional 100,000 people for the 2016 Christmas holiday period. This 25% jump on last year is to fill roles in the fulfilment and sorting facilities.

Westfield management understand the importance of innovation and the convergence between physical and digital and focus on the consumer experience.

Innovation and change are a natural part of business evolution, but integration into mainstream daily use takes much longer than investors think. Similar to virtual reality headwear discussed above, it is important for equity investors to not invest in the hottest new technology or innovation, rather buy into quality businesses that have a meaningful ability to change their approach. At WaveStone our preference is to find well established, well capitalised businesses which have a culture that will allow them to adapt.

Bill Gates wrote in his book The Road Ahead “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten. Don’t let yourself be lulled into inaction.”

The impact on equity investments

For companies undergoing disruption, the market discounts the earnings multiples they are prepared to pay. This is often before the earnings actually being to start falling.

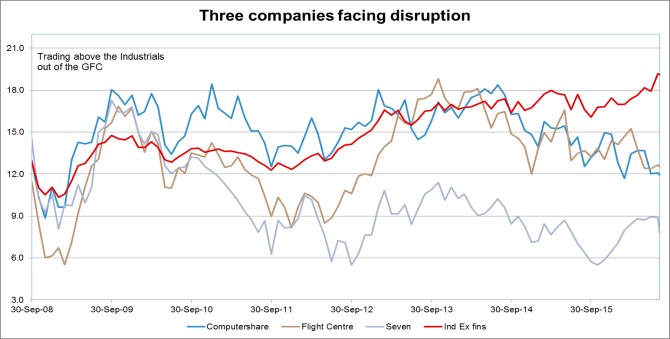

The chart below shows the price to earnings multiple of three Australian businesses that are currently open to disruption: Seven West Media, Computershare and Flight Centre.

Source: WaveStone Capital

Following the GFC, all three companies were trading on significant premiums to the industrial ex financials benchmark. Today, they are trading at a meaningful discount. Clearly the market is expecting the future earnings to fall. Some may argue these are value opportunities, however unless those businesses can actively change the way they operate, and embrace the new technology that is impacting their businesses, they will more likely be value traps.

Disruption in the Australian market

| Company | Disruption |

| Seven West Media | Conglomerate of Kerry Stokes’ media assets in FY12 worth A$4.1 billion earning A$527 million EBITDA[1] .

Company reported A$318 million EBITDA in FY16 and expects earnings to be 15-20% lower in FY17. Eyeballs are moving to Netflix, Facebook and Google. |

| Flight Centre | Under threat from global online travel companies Expedia and Booking.com. Flight Centre earned the same EBITDA for the last four years.

How long will we continue to buy travel from a shop? |

| Computershare | An intermediary under threat from block chain technology. EBITDA has been circa A$500million for the last four years. Also impacted by interest rates. |

Source: WaveStone Capital.

Disrupting the disruptor

As discussed in the Seven West example, disruption is not new news in the media sector. Original disruptors came in the form of Seek.com.au, CarSales.com.au and RealEstate.com.au. All have captured the classified market, taking all the lucrative revenue streams from Fairfax and other traditional media. One of the risks these original disruptors are now facing is because their business models have been able to sustain such high operating margins; they themselves are potentially open to disruption.

REA Group (previously held by WaveStone) has a market cap of over A$7 billion, an operating margin greater than 50% and ROE (Return on Equity) of approximately 40%. REA is a wonderful example of a successful disruptor moving real estate advertising from classifieds to online. It has been one of the best performing stocks over the last ten years. In the 2016 financial year the average monthly visits to RealEstate.com.au grew by 20% and are 2.1x higher per month than that of the number two site in Australia. Viewers spend 6.1 times more time on their site than competitor sites. However could REA be disrupted not directly but by a different model being offered to sell real estate?

Recently two examples of newly created start-ups are looking to disrupt the real estate industry: UK Purple Bricks and Australian based BuyMyPlace.com.au. These businesses are initially looking to go after the current margin real estate agents take when selling your house. They offer a cheaper online alternative.

No doubt this will take some time and there are many unanswered questions on how much market share they will actually be able to take. They will need to use RealEstate.com.au to advertise. (Currently BuyMyPlace.com.au has over 1,300 properties for sale on RealEstate.com.au). How long will it take for the number of house sales to increase and the number of real estate agents to reduce? Importantly how long will it take before their own websites contain enough information to attract eyeballs of potential buyers and sellers? Does this limit REA’s ability to keep raising prices? The real question is how REA management and the business will adapt to this threat.

As is typical with all the examples, disruption occurs relatively gradually, and these new participants will take a long time to be established and will burn through a lot of capital, so they themselves may not be great investments. However the impact needs to be monitored in any existing investment in the incumbent position in your portfolio, and be mindful of any new threat. As the founder of Amazon, Jeff Bezos, said “your margin is my opportunity.”

So to build a strong equities portfolio in a world of uncertainty and disruption we must remain vigilant to the risk, try to understand the impact, ignore the hype of the short term but be conscious of the long term threat. As stock pickers we want to back companies that have the right culture and accept like Westfield their business models must adapt.

[1] Earnings before Interest, Tax, Depreciation and Amortisation expense

Author: Catherine Allfrey, Principal and Portfolio Manager