US Research Trip: 2019

As part of an annual company liaison program, we travelled to the US to better understand the economic conditions on the ground and the implications that would have on our investee companies. Given the changes we continue to witness in consumer behaviour, disruptive technology and demographics which have a huge bearing on the way companies react and progress, the discussions have certainly helped frame how we invest in the Australian context.

Our key findings following this research trip:

- Despite recent anxiety of an upcoming recession, there is an underlying strength in the US economy. The consumer remains confident, unemployment is at 50-year lows and low (and falling) interest rates are supportive for the interest rate sensitive sectors of the economy.

- US housing has recovered well in the last six months as interest rates ease back, home sales increase, and new home inventories reduce.

- We have seen a maturation in the casino and gaming businesses as operators focus on reducing gearing and increasing monetisation from the existing user base, we will likely see further consolidation both in casinos and social gaming firms.

- While oil and gas exploration & production firms are being rewarded for continued focus on capital discipline, the lack of spending has leaked into the broader sector of service providers, squeezing profitability.

US Economy

A key finding from our trip last year (2018 September) was that the US economy was over-heating and asset markets were under-estimating the Fed’s resolve to keep raising rates. This was in fact true and the Fed did increase the Fed Funds rate four times in 2018 to 2.5%. What is now clear (in hindsight) was that the global economy (and hence the US) couldn’t cope with the rise in interest rates and the ascent in the US dollar. Global markets swooned, the Fed quickly retraced its path, responding through two 25 basis points rate cuts.

The US corporates we saw this time continue to be quite optimistic. Unemployment is low. The consumer is spending. The issues from the last two years around finding quality labour and productivity remain, although alleviated by an increase in automation. The US banks are not witnessing any stress in consumer or corporate balance sheets. Both Wells Fargo and JP Morgan were quite positive on the US consumer.

Low rates were certainly a focus. Net interest margins are still high in the US and both Wells ad JP Morgan remain reasonably confident that they will likely be able to protect margins, citing their resilient NIM performance through the GFC. Both banks spend US$10B+ a year on technology – they were confident that fintech firms were not going to destroy their profit pools. They believe start-ups were largely focused on trying to capture the customer interface and their inability to scale meant that they were more likely to partner with the big banks than compete against them.

Tariff related uncertainty is most felt in the manufacturing and services industry as reflected in corporation’s reluctance to invest, even with persistent consumer spending and confidence.

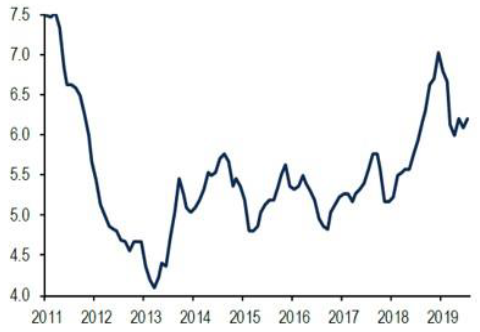

Housing, which stalled when the 30-year mortgage rate went to ~5%, has recovered well in the last six months. Whilst new housing starts are still down on last year, new home inventory has fallen as builders have reduced prices to clear product. Our investment in James Hardie has been predicated on growing share of its fibre cement siding in the exterior cladding market in the US (20% market share). The company today derives a third of its North American business from new housing construction, and after having a tough few years the firm has resurged strongly on the back of the recovering housing market.

Chart 1: Months’ supply of new homes (months, 6-mo average)

Source: Census Bureau

Chart 2: Starts underperform relative to sales (000s saar, 6-mo average)

Source: Census Bureau

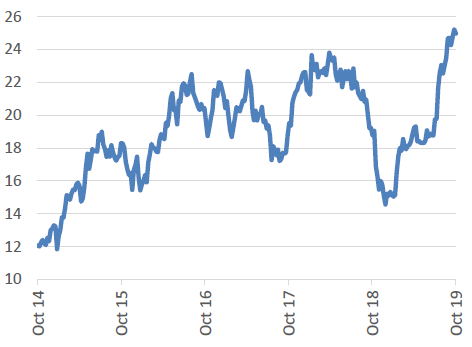

Chart 3: James Hardie share price ($)

Source: IRESS

Gaming

In past cycles, nowhere has the US boom bust cycle more spectacularly apparent than in Las Vegas. This time has certainly been different. The debt fuelled binge by the casino operators from the last cycle is still being unwound. Our meetings with Wynn and MGM showed that they are being run like mature businesses; the operators are focused on generating free cash flows, reducing gearing and increasing productivity across their various properties. These businesses generate a lot of cash and given the lack of greenfield growth options, we anticipate that companies such as Star and Crown will continue to attract corporate interest.

This is positive news for another holding of ours – Aristocrat, combined with the casino customers preference for the current Aristocrat portfolio, Aristocrat’s position in North American gaming operations looks as solidified and competitive as ever. Aristocrat’s Video Gaming Technologies business continues to perform well, benefiting from strong population growth in the Dallas area.

Aristocrat’s social gaming business continues to perform, especially its recently launched strategy game Raid that is annualising revenues of ~US$200M. With penetration of smart phones largely complete, the business has turned to increasing monetisation from the current user base, especially in its social casino business. Acquisitions of Plarium (US$500m) and Big Fish (US$990m) have given the firm this capability. With the social gaming category likely to grow double digits for a while yet, we believe that Aristocrat is well positioned to participate in the medium term.

Exploration and Production (oil and gas companies)

Last year, one of our key observations from the Exploration and Production (E&P) meetings was the focus on capital discipline. That behaviour has spread to the broader sector – E&P companies remained focused on cash generation and spending well within their means. Our meetings with service providers Schlumberger and Fluor aptly reflected the other side of the coin – the significant adverse impact on their profitability from the lack of spending by their clients! Both these businesses have had a difficult period – new management in each instance is focused on improving margins and increasing returns for shareholders. Given significant losses borne from fixed price contracts, it appears that investors are now heavily focused on contract profitability.

This is an important development in the context of the Australian E&P sector who are embarking on some big Liquefied Natural Gas (LNG) projects – our expectation is that some of that risk will now be borne by E&P shareholders going forward and it is something we are cognizant of given our investments in Oil Search and Woodside Petroleum.

Author: Raaz Bhuyan, Principal and Portfolio Manager