Will falling house prices tip Australia into a recession?

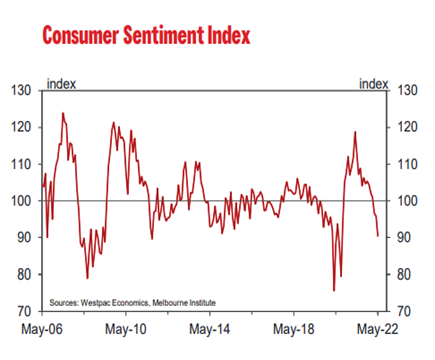

With the RBA tightening cycle firmly underway, the impact for Australian households is only starting to be felt. Dwelling prices are falling most notably in Sydney and Melbourne where 39% of households reside but have 53% of total housing debt1. The pace of rate hikes is at levels not seen since 1994 and combined with rising energy costs and higher food prices it is not surprising that consumer sentiment has fallen sharply as shown in the chart below.

What does this mean for consumer spending and is a recession on the cards?

Relative to other developed markets, Australia’s economy has been strong; boosted by high commodity prices, lower relative interest rates, a weak Australian dollar and solid household balance sheets. A lower exposure to long duration technology stocks (which have been hardest hit) has also provided some insulation from the global equity sell-off. For the six months ending June 30, 2022, the total return for ASX300 is -10.4% compared to -20% for the S&P500 and -20.3% for MSCI World.

Looking forward from here, vulnerabilities are apparent and none more so than in the housing market. Having spoken to bank executives, real estate businesses and developers over the past year, we expect a contraction in the housing market. The evidence is mounting even though price falls have been modest thus far.

- Higher mortgage rates have led many buyers to pause their plans.

- The time needed to sell a home has lengthened.

- There is a lower level of urgency amongst buyers.

- The HomeBuilder stimulus pulled forward demand and skewed sales.

- Foot traffic in display homes is a good indicator of where house sales will end up year on year and traffic is down 30%. This is already leading to lower conversion rates.

- Rising interest rates, higher material costs and supply chain issues are leading to higher prices for builders and developers.

- While there is a big backlog of work, a key risk ahead is bank financing in a rising interest rate environment.

However, in our view, the outlook is not as grim as media reports would suggest with a fall of 15% likely over the next 18 months. This is due to the expected influx of immigration now that borders are open as well as the structural shortage of housing stock which puts a floor on house prices.

While a 15% fall in the housing market would be material, there is also a wealth effect to consider. The magnitude of the hikes is massive at the margin. Even for those who do not face mortgage stress, higher mortgage payments dent consumer confidence and spending. The consequences are wide-reaching with impacts for the banking sector, construction, and ancillary businesses such as law firms and architects. Further, there is a significant refinancing event looming in 2023 as a large swathe of fixed rate loans roll off and many households will face a 40% increase in their repayments as they move to variable rates (based on current rates).

History teaches us that tightening cycles usually lead to a de-rating of P/E multiples for the banking sector. While steady interest rate rises are seen as a positive tailwind, with every 25bps increase leading to a 1-2bps positive boost to net interest margins, the sheer pace of the current increases creates a different outlook. While the banking sector is already down by 10% since the start of June, and has underperformed the broader market, looking forward the downturn in the housing market will lead to lower credit growth, lower margins and higher bad and doubtful debts. According to Jarden Research, new home growth leads bank share prices by approximately 3 months and bank share prices lead house prices by 5 months given the lag in house price data and the forward-looking nature of markets.

A de-rating of major bank share prices occurred in Australia during the 1999-2000 and 2009-2010 cycles when multiples fell by an average of 2.0x in the first three months after the first hike and 4.2x by the time of the last hike2. New Zealand, which is further ahead of Australia on rates is already experiencing a slowdown in credit growth. While Australian banks are well capitalised with very strong balance sheets, the medium-term outlook for their share prices will be negatively impacted by a housing downturn.

A slump in consumer discretionary spending is expected as households tighten their belts. The question for investors is how much of this is already priced in? Many stocks in this sector have already fallen significantly as consumers have shifted their spending from goods to services and earnings have normalised. Despite this, in our view, the consensus forecasts for FY23 and FY24 are still too optimistic. We have not seen earnings downgrades yet and this could occur in the coming weeks. While reporting season is likely to show strong results on a historical basis, analysts will focus their attention on forward looking guidance for earnings – or lack thereof.

For retailers, in addition to the rising cost of debt, analysts will be watching inventory levels. In many cases, inventory levels have been rising as supply chain issues ameliorate and are indicative of falling demand. The US provides a good indicator of the outlook for Australia given their rate hiking cycle and emergence from pandemic lockdowns is about 6 months ahead of Australia. What is evident is that retail is struggling with rising mortgage costs impacting consumers spending patterns. This is most evident for furniture, electronics and hardware sales which are highly correlated with housing growth.

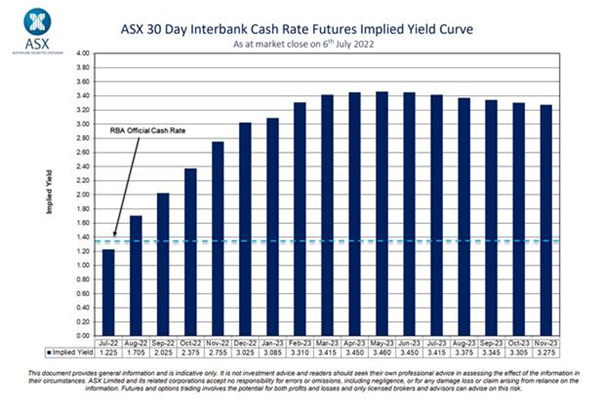

Whether or not we get a recession in Australia will depend largely on how aggressive the RBA is in raising rates. A neutral rate of 2.5% for example would dramatically impact borrowing capacity. Future inflation prints will determine whether the RBA stops there, and time will tell whether the current level of pessimism is overdone. As shown in the chart below, the market is expecting rates to peak in May 2023 with softer economic growth leading to rate cuts thereafter.

We have assessed the implications of a downturn in the housing market and falling consumer spending for investee companies on a bottom-up basis. We are underweight sectors such as financials and property trusts as well as those retailers more likely to be impacted by lower discretionary spending. We have long been overweight healthcare, which has proven to be resilient in previous downturns.